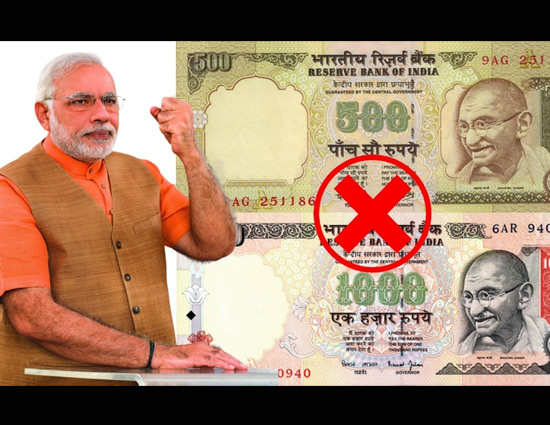

Republic Day 2018- Good And Bad Side Of Indian Currency Demonetization

By: Sandeep Gupta Thu, 25 Jan 2018 12:51:18

The government of India recently took a bold step to demonetize Rs 500 and Rs 1000 currency, which means that the legal tender of currency units is declared invalid from the specified date. Demonetization of currency means discontinuity of the said currency from circulation and replacing it with a new currency. Most of the people hailed the Modi's strong decision, while poor were shocked by the move.

The overnight decision changed the life of many as black money holders were worried about the pile of cash they were sitting on. Many poor daily wage workers were left with no job and income as owners were unable to pay their daily wage. It is no doubt a bold step taken by the government which will definitely help India to become corruption-free. Here are some advantages and disadvantages of de-monetization:

* Black Money tracking

This move will help the government to track unaccounted black money or cash on which income tax has not been paid. Individuals who are sitting on a pile of cash usually do not deposit the amount in the bank or invest anywhere as they would be required to show income or submit PAN for any valid financial transactions. They would hide it somewhere and use it as and when necessary.

* Reduction in illegal activity

Banning high-value currency will halt illegal activity as the cash provided for such activities has no value now. Black money is usually used to fund the illegal activity, terrorism, and money laundering. Fake currency circulation will come to a halt in a single shot. Corrupt officers, money launderers are under threat as Income tax department is taking all the measures to track such people.

* Tax payment

Most of the businessmen who have been hiding some income are ready to pay advance tax as current year's income. Tax payers who have been hiding some income can come forward to declare income and pay tax on the same. Individuals are required to submit PAN for any deposit above Rs 50,000 in cash, which will help tax department to track individuals with high denominations. Also, deposit up to Rs 2.5 lakh will not come under Income tax scrutiny.

* Jan Dhan

Yojana Now individuals are depositing enough cash in their Jan Dhan accounts which they were reluctant to do so a few days back. The amount deposited can be used for the betterment of the country.

* Disadvantages of Currency Demonetization

It may cause inconvenience for initial few days for those who have to start running to the banks to exchange notes, deposit amount or withdraw the same. The situation can turn chaotic if there is a delay in the circulation of new currency. Individuals who have an upcoming wedding are the ones who have to make alternative arrangements to make payments. However, the government has given higher withdrawal limit in such cases.

* Cost of currency destruction

After the news, we have seen that many individuals have burnt their cash and discarded the same, which is a loss to the economy. The government has to bear the cost of printing of new currency and its circulation. It makes sense when benefits of demonetization are higher. The cost of currency printing is a burden on the tax payers and is one of the many disadvantages of de-monetization.